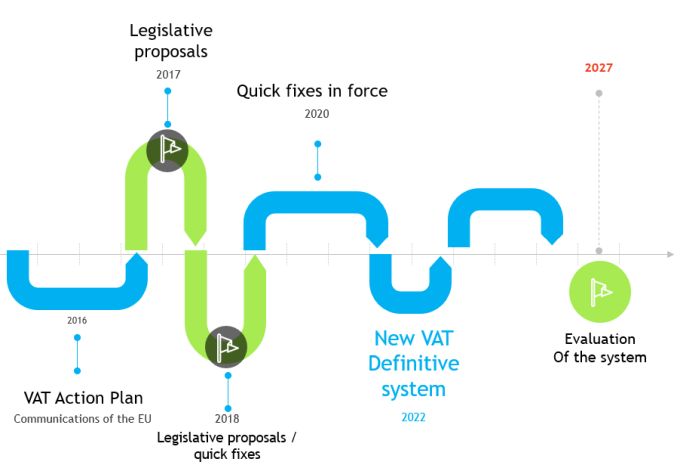

11 April 2016 1. European Commission publishes VAT Action Plan On 7 April 2016, the European Commission tabled its VAT Action P

EUROPEAN COMMISSION Brussels, 7.12.2018 SWD(2018) 493 final COMMISSION STAFF WORKING DOCUMENT Tax Policies in the European Unio

The voting of EU members for common consolidated corporate tax base and the tax benefits in: Central European Economic Journal Volume 7 Issue 54 (2020)